ADB Announces Ambitious Expansion of Financing to Tackle Regional Challenges

In a significant move to bolster development across the Asia-Pacific region, the Asian Development Bank (ADB) has unveiled plans to increase its annual financing capacity from USD 24 billion in 2024 to an impressive USD 36 billion by 2034. This 50% expansion aims to enhance ADB’s ability to address pressing regional issues and promote sustainable […]

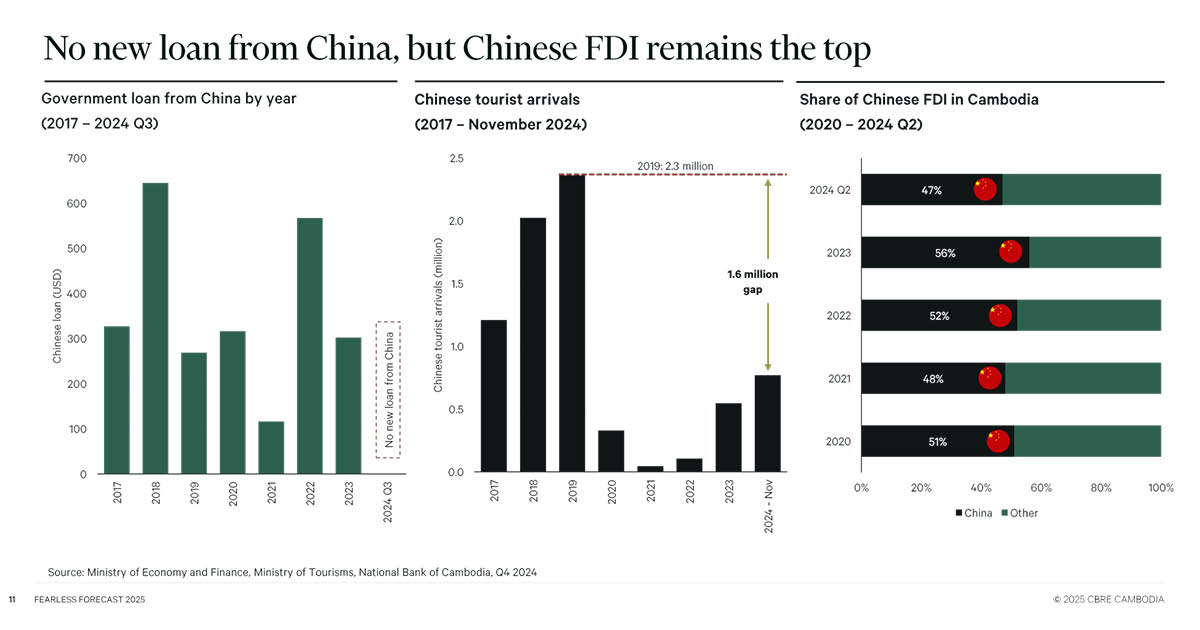

USAID’s Withdrawal Paves the Way for China’s Expanding Influence in Cambodia & ASEAN

The abrupt freezing of USAID funding under the Trump administration has halted vital infrastructure and development projects across Southeast Asia, leaving a geopolitical vacuum that China is poised to fill. With USAID’s cessation, critical services in Cambodia—including healthcare, education, and demining efforts—face significant disruption. The United States, which allocated nearly USD 68 billion in foreign […]

ASEAN Real Estate Markets Navigate Headwinds as China’s Economy Falters

The USD 722 billion trade relationship between China and ASEAN faces unprecedented pressure as China’s property sector, which accounts for over 25% of its GDP and 70% of household wealth, shows serious signs of distress amid plummeting consumer confidence that reached near-record lows of 86 in July 2024, according to Evrimagaci.org on 31 January 2025. […]

Southeast Asian Real Estate Markets Poised for Unprecedented Growth

Southeast Asia’s real estate landscape is experiencing a transformative shift, with premium properties in Singapore’s city center commanding USD 20,000 per square meter while emerging markets like Cambodia offer entry points as low as USD 1,000 per square meter. This comprehensive market analysis draws from extensive regional property data and market forecasts across five key […]

Cambodia’s Real Estate Market Faces Mixed Signals Amid Regional Benchmarks

Cambodia’s commercial real estate market reveals significant challenges with office occupancy rates at 65.1%, well below the international benchmark of 85-90%, while maintaining premium rents at $27 per square meter, according to the “Fearless Forecast” report presented by CBRE Cambodia Chairman Marc Townsend at Novotel Phnom Penh BKK1 on 14 January 2025. The retail sector […]

Cambodia Poised for Economic Windfall as U.S. Trade Policy Shifts from Vietnam

Cambodia stands to emerge as a major beneficiary of potential U.S. trade policy shifts, with experts predicting significant manufacturing opportunities if Donald Trump returns to office, particularly as Vietnam faces possible trade tariffs similar to those previously imposed on China, according to 2025 Fearless Forecast shared at a Real Estate Forum in Novotel Phnom Penh […]

ខ្មែរ

ខ្មែរ