Operating a hotel through a lease agreement or a hotel management agreement

When deciding to develop and operate a hotel, the parties may enter into a lease agreement or a hotel management agreement. Both have advantages and inconveniences.

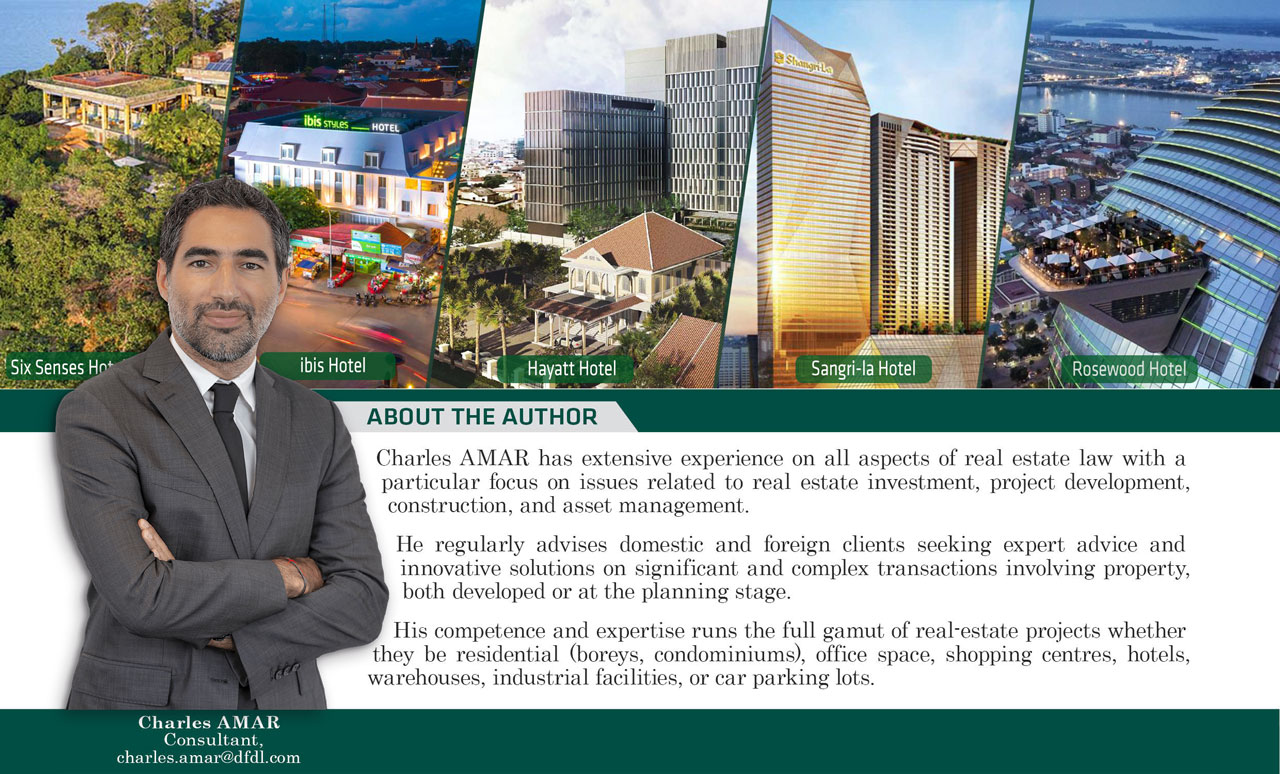

A study of the Cambodian market indicates significant growth in the number of tourists visiting Cambodia, leading to a significant development of the hospitality sector in Phnom Penh, Siem Reap and Sihanoukville. Emblematic of this growth is the numerous high-level international hotel groups operating in Cambodia such as Rosewood in Phnom Penh, Six Senses on Krabey Island, Alila on Koh Russey, and Ibis in Siem Reap along with many others under construction and soon to open their doors such as the Park Hyatt, and Novotel among others.

If the opening of a hotel requires the securing of a specific license from the Ministry of Tourism (if it has more than 20 rooms) or from the Provincial Department of Tourism (less than 20 rooms), the relationship between the hotel operator and the owner of the building is governed either by a lease agreement or by a hotel management agreement (“HMA”).

Whether to execute a lease agreement or a HMA gives rise to various pros and cons for the parties.

Indeed, when executing a lease agreement, the hotel operator is the owner of the hotel business and assumes all the risks relating to the hotel’s operations. The hotel operator is responsible for obtaining all the authorisations, licenses and permits to lawfully operate the hotel, including any restaurant, bar or spa facilities located on the premises. The hotel operator is also the employer of all personnel working in the hotel and duly responsible for hiring them and paying their wages.

The hotel operator must purchase all the furniture, fixtures and equipment (“FF&E”) for the hotel and more generally be responsible for all debts related to the business.

When the parties decide to opt for a lease agreement, they typically enter into a perpetual lease in Cambodia with a term of between 15 to 50 years. Therefore, the hotel operator will be granted with extensive rights to use and enjoy the property. It will also receive a perpetual lease certificate from the Land Office once registered at the Land Registry in order to render the lease opposable against third parties.

In comparison with a lease agreement, when executing an HMA, the owner grants a mandate to the hotel operator under which it will manage the hotel on behalf of the owner. In such a scenario, ownership of the building and the hotel business remains with the owner who assumes all the risks related to the hotel’s operations. The hotel operator will only manage the hotel in terms of providing direction, supervision and expertise to the owner. The hotel operator brings its brand, network and knowledge.

Originating in Asia during the 60s, particularly in Hong Kong, the HMA was formerly drafted on the basis of a lease agreement. Today, it is a very long, detailed and comprehensive contract that may be very complicated for those not familiar with it.

Generally, the HMA is a long-term contract between 10 to 20 years and the operator will have almost exclusive control over the hotel including the power to set the room rates and the hotel budget, along with setting the marketing strategies and internal policies of the hotel. The hotel operator will also hire staff on behalf of the owner and make decisions to purchase, remove or replace the FF&E.

Therefore, the owner will bear all the risk and will not have control over the hotel business. However, it will benefit from the brand, expertise and knowledge of the hotel operator.

In Cambodia, the HMA is governed in particular by Article 637 and seq. of the Cambodian Civil Code as it is a mandate.

The operator, therefore, has a duty of care, a duty to report, and an obligation to deliver to the owner the funds and other items that it receives in the course of its management activities (i.e. the incomes as outlined in Articles 640 to 642 of the Cambodian Civil Code.

Unlike a perpetual lease, the hotel operator will not be granted with a specific title when signing a HMA as this is not registered at the Land Registry.

Therefore, when choosing between a lease or a HMA, the parties must give due consideration as to which solution is the most optimal for their project. This choice will have significant impacts on the project and the relationship between the parties. The parties shall also review the tax implications of each option for them.

There is no clear ‘winner’ in terms of whether an HMA or a lease is the ideal solution in the same way that there is no uniquely best operator or brand. It will, above all, hinge upon the particularities of each situation, party and project.

Generally speaking, however, international hotel operators prefer to execute HMAs rather than leases in order to mitigate their financial liability attached to running the hotel. They will also not need to draw on their own equity reserves to develop new hotels and extend their brands.

In conclusion, two options are open to the parties when deciding whether to operate a hotel. They can either execute a lease agreement or an HMA. Both have advantages and inconveniences. Finding the right operator or brand is one of the most crucial components towards ensuring a viable and long term hotel project. It may bring significant impacts to bear on the design, operation and financing of the project. It will also affect the value of the asset. The hotel operator will bring its expertise, knowledge, brand and network. Apart from appointing the right operator, the terms and conditions of the agreement and the choice of a contract will be key, as it will generally govern the relationship between the parties for decades and prove difficult to amend once executed.

About the Author

Charles AMAR has extensive experience in all aspects of real estate law with a particular focus on issues related to real estate investment, project development, construction, and asset management.

He regularly advises domestic and foreign clients seeking expert advice and innovative solutions on significant and complex transactions involving property, both developed or at the planning stage.

His competence and expertise run the full gamut of real-estate projects whether they be residential (boreys, condominiums), office space, shopping centres, hotels, warehouses, industrial facilities, or car parking lots.

Charles AMAR is a consultant working with Sarin & Associates in collaboration with DFDL.

For further information, please contact him at the following address:

No 30, Preah Norodom Boulevard, 4th floor Bred Bank Building, Sangkat Phsar Thmey 3, Khan Daun Penh (PO Box 7), Phnom Penh, Kingdom of Cambodia,

T: +855 23 210 400 | M: +855 68 68 66 02 | E: charles.amar@dfdl.com

This publication is for your information only. It is not intended to be comprehensive and it does not constitute and must be not relied on as legal advice. You must seek specific advice tailored to your circumstances.

The information contained in this article is provided for information purposes only and is not intended to constitute any legal advice. Legal advice should be obtained from qualified legal counsel for all specific situations. Unless otherwise indicated, Charles Amar owns the copyright of this article. If you seek to reproduce or otherwise use this article or any part of it in any way, it is your responsibility to obtain approval for such use where necessary.

Informal translated by Construction & Property Magazine

- Video Advertisement -

ខ្មែរ

ខ្មែរ