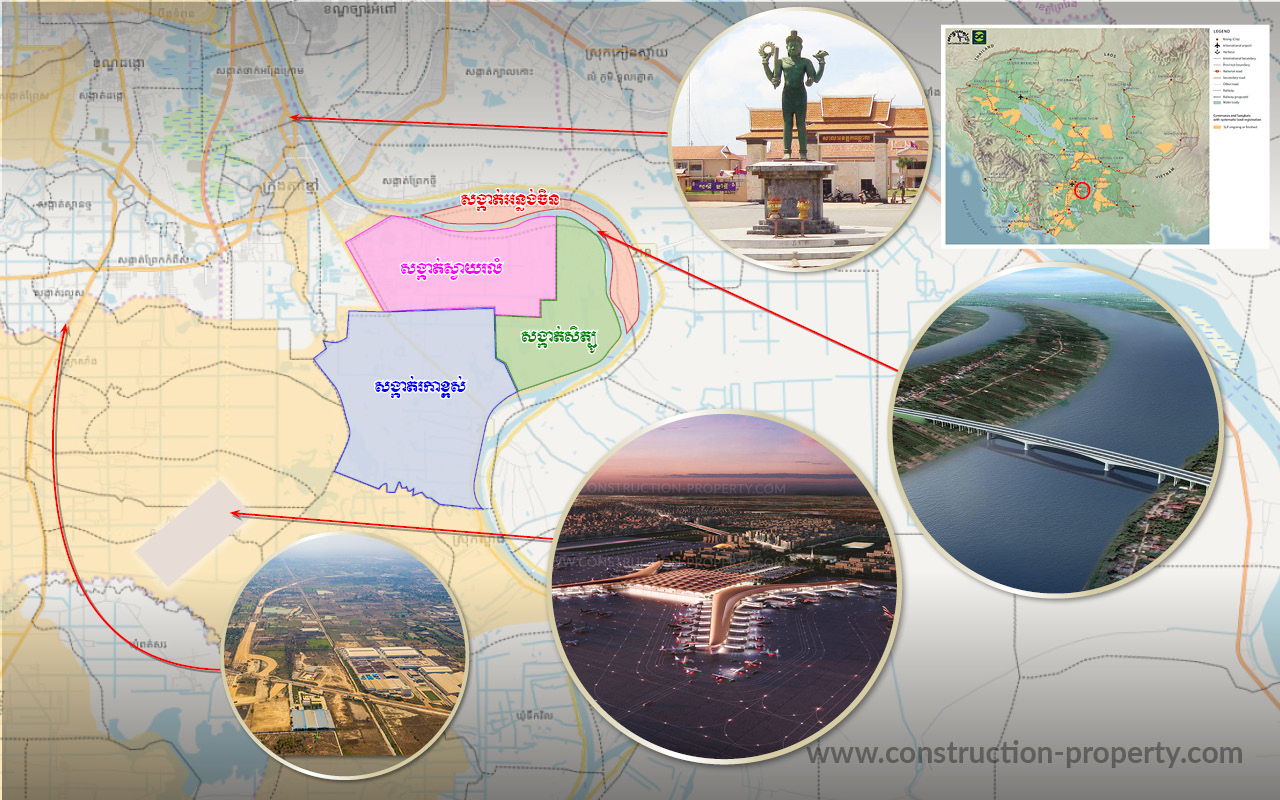

រដ្ឋាភិបាលកម្ពុជាសម្រេចជាផ្លូវការនូវការដកខ្លួនចេញពីតំបន់ត្រីកោណអភិវឌ្ឍន៍កម្ពុជា-ឡាវ-វៀតណាម

រដ្ឋាភិបាលកម្ពុជា បានប្រកាសជាផ្លូវការនូវដកខ្លួនចេញពីតំបន់ត្រីកោណអភិវឌ្ឍន៍កម្ពុជា-ឡាវ-វៀតណាម CLV-DTA តាមរយៈនិរាករណ៍ច្បាប់ស្តីពីការអនុម័តយល់ព្រមលើកិច្ចព្រមព្រៀងស្តីពីការជំរុញ និងសម្របសម្រួលពាណិជ្ជកម្មតំបន់ត្រីកោណអភិវឌ្ឍន៍កម្ពុជា-ឡាវ-វៀតណាម តាមរយៈ ព្រះរាជក្រម លេខ នស/រកម/១១២៤/០០៤ ចុះថ្ងៃទី ២១ ខែវិច្ឆិកា ឆ្នាំ២០២៤។ ច្បាប់នេះ មានអានុភាពអនុវត្តចាប់ពីថ្ងៃដែលការដកខ្លួនរបស់ព្រះរាជាណាចក្រកម្ពុជាបានចូលជាស្ថាពរដោយផ្អែកតាមកិច្ចព្រមព្រៀងស្តីពីការជំរុញ និងសម្រួលពាណិជ្ជកម្មតំបន់ត្រីកោណអភិវឌ្ឍន៍កម្ពុជា-ឡាវ-វៀតណាម។ បើទោះបីជាការប្រកាសដកខ្លួនយ៉ាងនេះក៏ដោយ ប្រមុខរាជរដ្ឋាភិបាលកម្ពុជា សម្តេចធិបតី ហ៊ុន ម៉ាណែត បានប្រកាសពីជំហរថា នឹងបន្តអភិវឌ្ឍបណ្តាខេត្តទាំង៤ នៅតំបន់ភូមិភាគឦសាន្តរបស់កម្ពុជា ដោយមិនមានការប្រែប្រួលនោះទេ ដោយរួមមានការបោះបង្គោលព្រំដែនជាមួយប្រទេសជិតខាង ការកសាងហេដ្ឋារចនាសម្ព័ន្ធតភ្ជាប់ជាពិសេសផ្លូវក្រវាត់ព្រំដែន និងការដាក់ចេញនូវកញ្ចប់លើកទឹកចិត្ត និងជំរុញការវិនិយោគខេត្តភូមិភាគឦសាន្តឆ្នាំ២០២៥ ជាដើម។ (អានបន្ថែម) ថ្មីនេះៗផងដែរ រាជរដ្ឋាភិបាលកម្ពុជា បានបើកការដ្ឋានសាងសង់ផ្លូវក្រវ៉ាត់ព្រំដែនប្រវែង ២៥០គ.ម ក្រោមមូនិធិសរុបជិត ២៦.៩៦៧.៦០៩លានដុល្លារអាមេរិក នៅថ្ងៃទី១ វិច្ឆិការ ឆ្នាំ២០២៤ និងគ្រោងបញ្ចប់នៅចុងខែមេសា ឆ្នាំ២០២៧ ដែលមាន ០៤ខ្សែ ក្នុងនោះ ក្នុងភូមិសាស្ត្រខេត្តមណ្ឌលគិរី ប្រវែង ១៤៧,៤២ គីឡូម៉ែត្រ និងក្នុងខេត្តរតនគីរីប្រវែង ១០២,៥៨ គីឡូម៉ែត្រ។(អានបន្ថែម) គួរបញ្ជាក់ថា អំឡុងពេលអនុវត្តកិច្ចព្រមព្រៀង CLV-DTA […]

ត្រឹមរយៈពេល៣ថ្ងៃ អាជ្ញាធរបង្រ្គាបបទល្មើសរ៉ែអានាធិបតេយ្យក្នុងខេត្តមណ្ឌលគីរីបាន ៥៦ទីតាង

ត្រឹមរយៈពេល៣ថ្ងៃ ពោលគិតចាប់ពីថ្ងៃទី៣-៥ ខែវិច្ឆិកា ឆ្នាំ២០២៤ អាជ្ញាធរនៃមន្ទីររ៉ែនិងថាមពល ខេត្តមណ្ឌលគិរី សហការជាមួយរដ្ឋបាលខេត្តមណ្ឌលគិរី មន្ទីរបរិស្ថានខេត្ត មន្ទីររៀបចំដែនដី នគរូបនីយកម្ម សំណង់ និងសុរិយោដីខេត្ត បានរកឃើញ និងបង្គ្រាបបទល្មើសរ៉ែអានាធិបតេយ្យនៅក្នុងខេត្តមណ្ឌលគីរី បានចំនួន៥៦ទីតាំង។ ថ្លែងក្នុងសន្និសីតសារព័ត៌មានកាលថ្ងៃទី០៦ ខែវិច្ឆិកា ឆ្នាំ២០២៤ ឯកឧត្តម អ៊ឹង ឌីប៉ូឡា អគ្គនាយកនៃអគ្គនាយកដ្ឋានធនធានរ៉ែ នៃក្រសួងរ៉ែ និងថាមពល បានឱ្យដឹងថា ប្រតិបត្តិការបង្ក្រាបក្នុងក្នុងតំបន់មេសំ ឃុំចុងផ្លាស់ ស្រុកកែវសីមា ខេត្តមណ្ឌលគិរី ចាប់ផ្តើមអនុវត្តកាលពីថ្ងៃទី៣ ខែវិច្ឆិកា ឆ្នាំ២០២៤ បានរកឃើញ និងបង្គ្រាបបានចំនួន ៥៦ទីតាំង នៅក្នុងនោះគឺមាន៣៣អណ្តូង និងទីតាំងកិននិងរែងរ៉ែចំនួន២០ទីតាំង ហើយ៣ទីតាំងទៀតជាទីតាំងអណ្តូងចាស់ដែលមិនប៉ះពាល់ ខណៈបេសកកម្មនេះ នឹងបន្តបីបួនថ្ងៃទៀតដើម្បីឈានដល់ការបិទបញ្ចប់ជាស្ថាបពរ។ ឯកឧត្តម បន្តថា ក្នុងចំណោមទីតាំង ទាំង ៥៦នេះ អាជ្ញាធរពាក់ព័ន្ធបានកំណត់ទីតាំងរ៉ែ អត្តសញ្ញាណ និងម្ចាស់ទីតាំងដីដែលអនាធិបតេយ្យច្បាស់លាស់រួចរាល់ហើយ នឹងបញ្ជូនទៅបន្តនិតិវិធីនៅតុលាការនាពេលឆាប់ៗនេះ។ គួរបញ្ជាក់ថា ដើម្បីបង្គ្រាបបទល្មើសរ៉ែខុសច្បាប់នៅកម្ពុជាឱ្យមានប្រសិទ្ធភាព ក្រសួងរ៉ែ និងថាមពល ប្រកាសដាក់ចេញវិធានការធំៗចំនួន៦ រួមមាន៖ […]

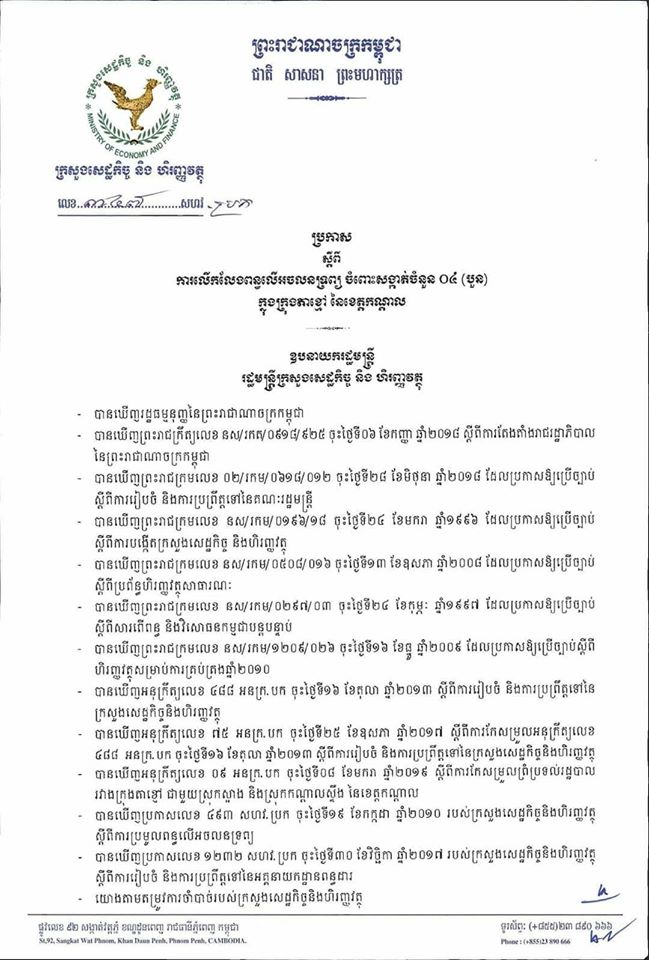

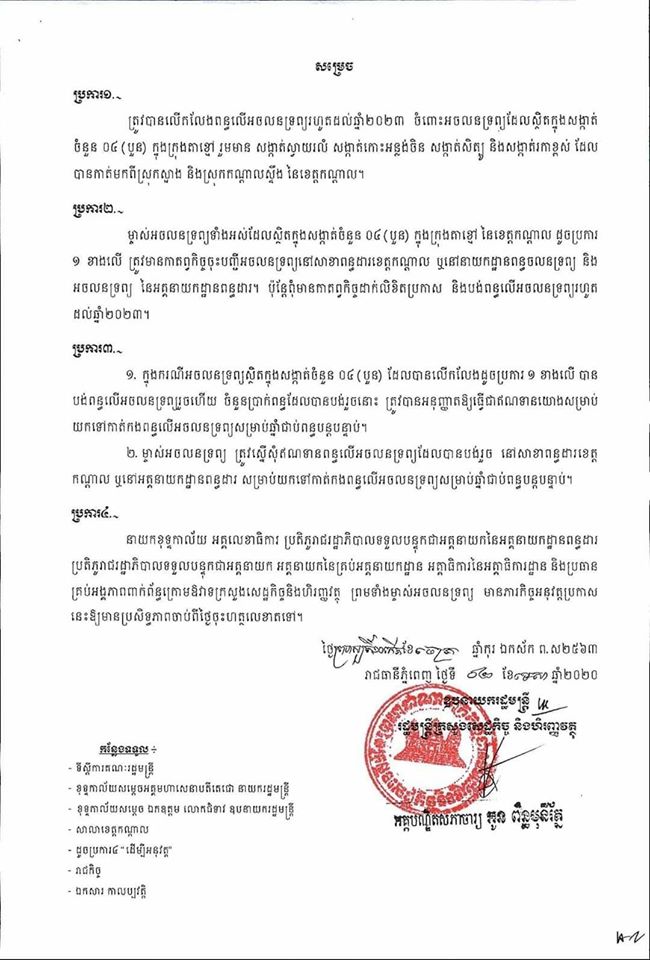

រដ្ឋសម្រេចបន្តលើកលែងពន្ធប្រថាប់ត្រា ផ្ទះតម្លៃក្រោម ឬស្មើ $៧ម៉ឺន រហូតដំណាច់ឆ្នាំ២០២៥

ក្រសួងសេដ្ឋកិច្ច និងហិរញ្ញវត្ថុ បានសម្រេចបន្តលើកលែងពន្ធប្រថាប់ត្រាលើការផ្ទេរកម្មសិទ្ធិ ឬសិទ្ធិកាន់កាប់លំនៅឋានគ្រប់ប្រភេទ ដែលមានលក្ខណៈជាបុរី ដែលមានតម្លៃក្រោម ឬស្មើ ៧ម៉ឺនដុល្លារអាមេរិក រហូតដល់ដំណាច់ឆ្នាំ២០២៥។ នេះបើតាមសេចក្តីជូនដំណឹងលេខ ០១៤ សហវ.ស.ជ.ណ ចុះថ្ងៃទី៩ ខែតុលា ឆ្នាំ២០២៤។ ប្រភពដដែលនេះ បានបន្តថា រដ្ឋនឹងបន្តអនុគ្រោះពន្ធប្រថាប់ត្រាលើការផ្ទេរកម្មសិទ្ធិ ឬសិទ្ធិកាន់កាប់លំនៅឋានគ្រប់ប្រភេទ ដែលមានលក្ខណៈជាបុរី និងមានតម្លៃលើស ៧០.០០០ដុល្លារ ដោយអនុញ្ញាតឱ្យដកទំហំទឹកប្រាក់ ៧០. ០០០ដុល្លារ ចេញពីមូលដ្ឋានគិតពន្ធប្រថាប់ត្រា សម្រាប់ការទិញលំនៅឋានក្នុងគម្រោងអភិវឌ្ឍន៍ លំនៅឋានជាបុរី ដែលមានអាជ្ញាបណ្ណអាជីវកម្មអចលនវត្ថុ និងបានចុះបញ្ជីត្រឹមត្រូវ រហូតដល់ដំណាច់ឆ្នាំ ២០២៥។ បន្ថែមពីលើនេះ រាល់ការផ្ទេរកម្មសិទ្ធិដែលទទួលបានការលើកលែងនិងអនុគ្រោះពន្ធខាងលើនេះ ត្រូវបំពេញនូវលក្ខខណ្ឌដូចខាងក្រោម៖ ការទទួលកម្មសិទ្ធិ ឬសិទ្ធិកាន់កាប់អចលនទ្រព្យដែលមានតម្លៃក្រោម ឬស្មើ ឬលើស ៧០.០០០ (ប្រាំពីរម៉ឺន) ដុល្លារ តាមតម្លៃទីផ្សារជាក់ស្តែងដែលមានចែងនៅក្នុងកិច្ចសន្យាទិញ-លក់ ចាប់ពីថ្ងៃទី២៥ ខែកុម្ភៈ ឆ្នាំ២០២០ ដល់ដំណាច់ឆ្នាំ២០២៥ និងមកធ្វើការប្រកាសបង់ពន្ធប្រថាប់ត្រានៅក្នុងអំឡុងពេលនេះ ការទទួលកម្មសិទ្ធិ ឬសិទ្ធិកាន់កាប់អចលនទ្រព្យ (លំនៅឋានគ្រប់ប្រភេទ) ពីក្រុមហ៊ុនអភិវឌ្ឍន៍លំនៅឋាន ដែលបានចុះបញ្ជីនៅក្រសួងសេដ្ឋកិច្ចនិងហិរញ្ញវត្ថុ (បច្ចុប្បន្ននិយ័តករអាជីវកម្មអចលនវត្ថុនិងបញ្ចាំ) ឬនៅ […]

ក្រសួងសម្រេចផ្អាកដំណើរការក្រុមហ៊ុនវារីអគ្គិសនីដ៏ធំ១ នៅពោធិ៍សាត់ និងកោះកុង ជាបណ្តោះអាសន្ន

ក្រសួងបរិស្ថានបានសម្រេចផ្អាកដំណើរការសកម្មភាពជាបណ្តោះអាសន្នរបស់ក្រុមហ៊ុនវារីអគ្គិសនីស្ទឹងមេទឹក ហាយដ្រូផៅវ័រ (Stung Meteuk Hydropower) របស់លោកអ្នកឧកញ៉ា លី យ៉ុងផាត់ ដែលមានទីតាំងស្ថិតក្នុងដែនជម្រកសត្វព្រៃសំកុស ភូមិសាស្ត្រខេត្តពោធិ៍សាត់ និងខេត្តកោះកុង។ នេះបើតាមលិខិតរបស់រដ្ឋមន្រ្តីក្រសួងបរិស្ថាន ចុះថ្ងៃទី ២ ខែកញ្ញា ដាក់ទៅលោកអ្នកឧកញ៉ា លី យ៉ុងផាត់ ដែលជាប្រធានក្រុមប្រឹក្សាភិបាលនៃក្រុមហ៊ុនស្ទឹងមេទឹកហាយដ្រូផៅវ័រខាងលើ។ តាមលិខិតខាងលើបានឱ្យដឹងថា ការផ្អាកនេះ ក៏ព្រោះតែក្រុមហ៊ុនវារីអគ្គិសនីស្ទឹងមេទឹក ហាយដ្រូផៅវ័រ របស់លោកអ្នកឧកញ៉ា លី យ៉ុងផាត់ ពុំបានអនុវត្តត្រឹមត្រូវតាមលិខិតបទដ្ឋានគតិយុត្ត ខ្លឹមសារណែនាំនៃសៀវភៅបន្ទុក ប្រមូលផល-អនុផលព្រៃឈើ និងការណែនាំរបស់រដ្ឋបាលខេត្តពោធិ៍សាត់ ព្រមទាំងសមត្ថកិច្ចមន្ទីរបរិស្ថានខេត្តពោធិ៍សាត់។ ជាងនេះទៅទៀត ក្រុមហ៊ុនបានធ្វើសកម្មភាពល្មើសនឹងបទប្បញ្ញត្តិនៃក្រមបរិស្ថាន និង ធនធានធម្មជាតិម្តងហើយម្តងទៀតខុសពីកិច្ចសន្យាររហូតដល់ទៅបីលើក ក្នុងនោះរួមមាន៖ ទី១. ការដឹកជញ្ជូនឈើដោយគ្មានលិខិតអនុញ្ញាត ល្មើសនឹងការចែងក្នុងមាត្រា៨៥០ ចំណុច (ង), ទី២. ការកាប់ ប្រមូលឈើក្រៅតំបន់បាតអាងវារីអគ្គិសនី ល្មើសនឹងការចែងក្នុងមាត្រា៨៥១ ចំណុច (ខ) និង ទី៣. ការដឹកជញ្ចូន កែច្នៃឈើ ដែលមិនទាន់បង់ថ្លៃសួយសារ ល្មើសនឹងការចែងក្នុងមាត្រា៩៨ នៃច្បាប់ស្តីពីព្រៃឈើ។ […]

កូរ៉េគ្រោងវិនិយោគវិស័យបរធនបាលកិច្ចនៅកម្ពុជា ដើម្បីពង្រីកទីផ្សារមួយនេះឱ្យរិតតែទូលំទូលាយ

ក្រុមហ៊ុន Mugungwha Trust Co., Ltd. របស់កូរ៉េ មានគម្រោងទៅវិនិយោគលើវិស័យបរធនបាលកិច្ចនៅប្រទេសកម្ពុជានៅពេលខាងមុខ ដើម្បីជួយអភិវឌ្ឍសេដ្ឋកិច្ច និងពង្រីកទីផ្សារបរធនបាលកិច្ចនៅកម្ពុជាឱ្យរិតតែទូលំទូលាយ ខណៈបច្ចុប្បន្នមានក្រុមហ៊ុនប្រភេទនេះត្រឹមតែ ៨ក្រុមហ៊ុនប៉ុណ្ណោះ។ នេះបើតាមជំនួបរវាងសម្តេចតេជោ ហ៊ុន សែន និង លោក Oh Chang-seok ប្រធានក្រុមហ៊ុននៅរសៀលថ្ងៃទី១០ ខែកញ្ញា ឆ្នាំ២០២៤ នៅទីក្រុងសេអ៊ូល សាធារណរដ្ឋកូរ៉េ។ ក្នុងជំនួបនេះ លោក Oh Chang-seok បានជម្រាបឱ្យដឹងថា ក្រុមហ៊ុន Mugungwha Trust Co., Ltd. ជាក្រុមហ៊ុនបរធនបាលកិច្ចរៀបចំថែទាំអគារទីក្រុង និងការអភិវឌ្ឍគម្រោងសាងសង់នានា ដែលកាលពី១០ឆ្នាំមុន ក្រុមហ៊ុនរបស់លោកធ្លាប់បានមកធ្វើការសិក្សានៅប្រទេសកម្ពុជា អំពីបរធនបាលកិច្ច ក្នុងគោលបំណងចង់រួមចំណែកក្នុងការវិនិយោគនៅប្រទេសកម្ពុជា ខណៈពេលនោះមិនទាន់មានក្រុមហ៊ុនណាមកវិនិយោគនៅឡើយ។ ជាងនេះទៅទៀត លោកក៏បានបន្ថែមថា ក្រុមហ៊ុនរបស់លោក អាចជាសសរដ៏រឹងមាំមួយសម្រាប់ការអភិវឌ្ឍប្រទេសកម្ពុជា និងតំបន់។ នៅក្នុងទិសដៅនេះ ក្រុមហ៊ុនរបស់លោក ត្រៀមខ្លួនរួចជាស្រេចក្នុងការសិក្សាអំពីប្រព័ន្ធច្បាប់ធនាគារ ហិរញ្ញវត្ថុរបស់កម្ពុជា ដើម្បីសហការជាមួយក្រុមហ៊ុនឯកជននៅប្រទេសកម្ពុជាក្នុងការពង្រីកទីផ្សារបរធនបាលកិច្ចនេះឱ្យរិតតែមានភាពទូលំទូលាយថែមទៀត។ លោកបន្ត បច្ចុប្បន្ននៅកម្ពុជា ក្រុមហ៊ុនប្រភេទនេះត្រឹមតែ ៨ក្រុមហ៊ុនប៉ុណ្ណោះ កំពុងធ្វើការនៅក្នុងប្រព័ន្ធបរធនបាលកិច្ចនេះ […]

អគ្គនាយកដ្ឋានពន្ធដារប្រកាសឱ្យទៅបង់ពន្ធអចលនទ្រព្យឱ្យបានត្រឹមថ្ងៃទី៣០ កញ្ញា ២០២៤

អគ្គនាយកដ្ឋានពន្ធដារ បានរំលឹកដោយប្រកាសឱ្យម្ចាស់អចលនទ្រព្យទាំងអស់ ដែលមានអចលនទ្រព្យស្ថិតនៅរាជធានី និង នៅតាមបណ្តាខេត្តទាំងអស់ អញ្ជើញទៅបង់ពន្ធលើអចលនទ្រព្យ និងពន្ធលើដីធ្លីមិនបានប្រើប្រាស់ ឱ្យបានត្រឹមថ្ងៃទី៣០ ខែកញ្ញា ឆ្នាំ២០២៤នេះ។ នេះបើតាមសេចក្តីជូនដំណឹងលេខ ២៧១៩៩ អពដ ចុះថ្ងៃទី៣១ ខែកក្កដា ឆ្នាំ២០២៤។ ការប្រកាសរំលឹកនេះ ក្រោយអគ្គនាយកដ្ឋាន បានសង្កេតឃើញថា មានម្ចាស់អចលនទ្រព្យមួយចំនួននៅមិនទាន់បានបំពេញកាតព្វកិច្ចប្រកាសបង់ប្រាក់ពន្ធប្រភេទទាំងនេះនៅឡើយ។ ដូចនេះ ដើម្បីជំរុញការប្រមូលពន្ធលើអចលនទ្រព្យ និងពន្ធលើដីធ្លីមិនបានប្រើប្រាស់សម្រាប់ឆ្នាំ២០២៣ នេះ ដោយចៀសវាងនូវការកកស្ទះ ការប្រជ្រៀតគ្នាមកប្រកាសបង់ប្រាក់ពន្ធនៅថ្ងៃជិតផុតកំណត់ ម្ចាស់អចលនទ្រព្យទាំងអស់ ត្រូវមកបំពេញកាតព្វកិច្ចឱ្យបានត្រឹមថ្ងៃទី៣០ ខែកញ្ញា ឆ្នាំ២០២៤។ ម្ចាស់អចលនទ្រព្យទាំងអស់ ត្រូវបង់ពន្ធនៅអគ្គនាយកដ្ឋានពន្ធដារ ឬសាខាពន្ធដារខេត្ត-ខណ្ឌដែលអចលនទ្រព្យស្ថិតនៅ ឬនៅគ្រប់សាខាធនាគារដែលជាដៃគូររបស់អគ្គនាយកដ្ឋានពន្ធដារ ឬតាមរយៈកម្មវិធី “GDT Taxpayer App” ដែលអាចទាញយកមកប្រើប្រាស់ពី App Store ឬ Play Store។ ចំពោះការខកខានមិនបានដាក់លិខិតប្រកាសបង់ពន្ធទាន់ពេលវេលាកំណត់ទេ ម្ចាស់អចលនទ្រព្យ នឹងត្រូវរងទណ្ឌកម្មរដ្ឋបាល តាមច្បាប់ស្តីពីសារពើពន្ធជាធរមាន។ - Video Advertisement -

English

English